Shuo Yang*

Uppsala University, Uppsala SE-751 05, Sweden

*Corresponding email: yashtechy@163.com

Abstract

In today’s digital age, the financial market is increasingly showing its complexity and dynamics. With the continuous progress of science and technology, especially the rise of artificial intelligence technology, machine learning algorithms are more and more widely used in financial markets. As an important tool in the financial field, the accuracy and efficiency of the financial market forecasting model are directly related to the success or failure of investment decisions. The financial market forecasting model based on machine learning makes use of its powerful data analysis and learning ability to forecast the financial market accurately. However, the change of market environment and the complexity of data also put forward higher requirements for the forecasting model. In view of this, this paper will systematically explain the basic concepts and classification of machine learning, analyze the basic characteristics and influencing factors of financial markets, and deeply discuss the advantages of machine learning in financial market forecasting. This paper will also focus on the optimization principle and process of financial market forecasting model based on machine learning algorithms. Through the analysis and interpretation of relevant theories and practices, it is expected to provide more scientific and accurate solutions for financial market forecasting.

keywords

Machine learning, Financial market, Deep neural network

Introduction

In today’s digital era, as an important pillar of the global economy, the accuracy of financial market forecasting and decision-making is directly related to the interests of investors and the stability of the market. With the continuous development and application of machine learning technology, its powerful data processing and forecasting capabilities provide new ideas and methods for financial market forecasting. This paper aims to explore the financial market forecasting model based on machine learning and its optimization strategy [1].

Financial market forecasting involves quantitative analysis and prediction of various complex factors, such as market conditions, economic indicators and policy changes [2]. Machine learning, as an efficient and automatic data processing tool, has become the key technology of financial market analysis and prediction. From traditional statistical analysis methods to modern deep learning models, machine learning algorithms are increasingly widely used in financial markets, providing investors with more accurate decision support.

With the increasing amount of data and the changing market, the optimization of financial market forecasting model becomes particularly important. Therefore, this paper will introduce the optimization principle and process of financial market forecasting model based on machine learning in detail, to provide more effective methods and strategies for financial market forecasting [3].

Theoretical overview

Definition of machine learning

Machine learning is an interdisciplinary subject, which involves statistics, mathematics, computer science and other fields. It is a method that enables computers to automatically improve their performance through data and experience [4]. Machine learning uses algorithms to automatically analyze computers and obtain rules from many data, to predict or make decisions on new data. Its purpose is to enable computers to learn knowledge and skills from data like human beings, and to automatically identify patterns, classify and predict trends, which are widely used in many fields such as image recognition, speech recognition and natural language processing [5].

Basic characteristics and influencing factors of financial markets

The financial market is a complex system with many basic characteristics. For example, the price fluctuation in the financial market is uncertain and random, which is influenced by many factors. Furthermore, the information asymmetry in the financial market is obvious, and investors have different mastery of market information. Financial markets are also highly liquid and risky. There are many factors affecting the financial market, including macroeconomic factors, political factors and corporate fundamentals. Macro-economic factors such as economic growth, inflation and interest rates will have an impact on the whole market. Political factors such as changes in policies and regulations and tensions in international relations will also have an impact on financial markets [6-8]. The fundamental factors of the company, such as financial status and operating performance, will directly affect the price of the company’s stock.

Advantages of machine learning in financial market forecasting

Machine learning has many advantages in financial market forecasting. First, machine learning can process a large amount of data and dig out the potential patterns and laws in the data. The amount of data generated by financial markets is huge, and traditional analysis methods are often difficult to deal with, while machine learning algorithms can effectively deal with these data. Second, machine learning has strong adaptability and flexibility and can automatically adjust the model according to the changes in the market. The financial market is dynamic, and the machine learning model can capture the changes of the market in time and make corresponding adjustments [9]. Thirdly, machine learning can comprehensively consider various factors and improve the accuracy of prediction. The price of financial markets is influenced by many factors, and the machine learning model can take these factors into account, thus improving the accuracy of forecasting. Machine learning can also find some subtle patterns and relationships that are difficult for human beings to detect and provide a new perspective and method for financial market forecasting [10].

Financial market forecasting model

Financial market model based on machine learning algorithms

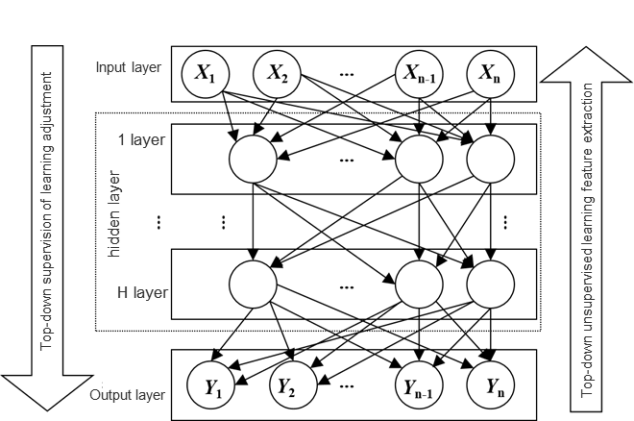

As a widely used machine learning algorithm, Deep Neural Network (DNN) is famous for its ability to stack features layer by layer. When optimizing for a specific goal, it can build a complex deep structure. In view of this, this study uses DNN model to forecast and analyze the financial market trend. The model structure of the deep neural network is shown in the following figure:

Figure. 1 Model structure of deep neural network.

Unsupervised learning is a typical feature of DNN model, and the input of each level is the feature obtained by the upper level of that level. X represents input and y represents output, then the output formula of the first hidden layer of the model is:

\[ h^{(1)} = g^{(1)} \left( W^{(1)} x + b^{(1)} \right) \cdots (1) \]

Its weight matrix formula is:

\[ W^{(1)} = \begin{bmatrix} W_{11}^{(1)} & W_{12}^{(1)} & \cdots & W_{1n}^{(1)} \\ W_{21}^{(1)} & W_{22}^{(1)} & \cdots & W_{2n}^{(1)} \\ \vdots & \vdots & \ddots & \vdots \\ W_{k1}^{(1)} & W_{k2}^{(1)} & \cdots & W_{kn}^{(1)} \end{bmatrix} \cdots (2) \]

In formula (1) and formula (2): represents the weight between the i and j units; x = (x1, x2, ··, xn)T and

h(1) = (h1(1), h2(1), ··, hk(1))T Mean representation vector represents the threshold vector of the model, and g(1) represents the activation function. Both n and k represent the number of units.

Financial market trend prediction steps based on machine learning algorithm

(1) Data collection and pretreatment:

Step 1: Data collection and pretreatment. It is necessary to collect a wide range of data including stock price, trading volume and macroeconomic indicators from multiple sources (such as exchanges and economic indicators databases). This stage also involves data cleaning, that is, dealing with missing values and abnormal values, and standardizing data in different formats to lay the foundation for subsequent analysis.

Step 2: Characteristic engineering. Feature engineering is the key to successful prediction. In this step, analysts need to extract meaningful features from the original data, such as moving average, relative strength index (RSI), volatility and so on, which can more directly reflect the market behavior. Feature selection may also be involved in optimizing model performance.

Step 3: Model selection and training. It is very important to choose suitable machine learning models, such as support vector machine (SVM), neural network and time series analysis. In the model training stage, historical data is used to learn market rules, and the model performance is optimized by adjusting parameters to ensure that the model can accurately capture market trends.

Step 4: Model evaluation and verification. Through cross-validation and set-aside method, the performance of the model on the unknown data is evaluated, that is, the prediction accuracy. It is also necessary to pay attention to the stability and interpretability of the model to ensure that the prediction results are accurate and easy to understand.

Step 5: Forecast and application. Use the optimized model to predict future financial market trends. Input new data into the model, get the forecast results, and make corresponding investment decisions or risk management strategies according to the forecast results.

It should be noted that the financial market is very complex and dynamic. Although machine learning algorithms can provide some help, it cannot guarantee completely accurate prediction. In practical application, it is necessary to combine other analyses and market experience to make a comprehensive judgment [11,12].

Optimization of forecasting model

Optimization principle based on machine learning algorithm

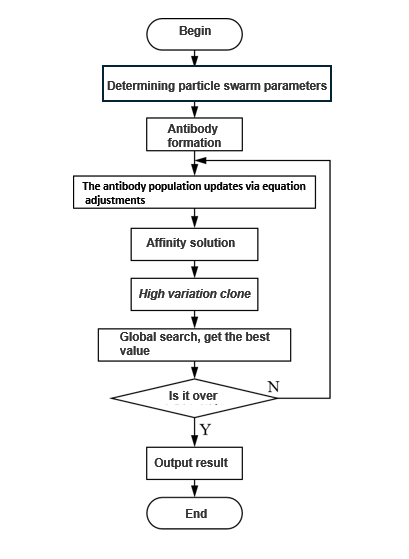

In the process of optimization, data is the key. A large amount of data in financial markets need to be carefully processed, including cleaning, screening and feature engineering, in order to extract valuable information [13]. By selecting appropriate features, such as price fluctuation, trading volume, market sentiment indicators, etc., it provides rich input for the model. The selection and adjustment of the algorithm is also very important. According to the data characteristics and forecasting requirements, select suitable machine learning algorithms, such as neural network, decision tree, support vector machine, etc. The parameters of the algorithm are optimized to improve the performance and accuracy of the model. Furthermore, the integrated learning method is needed to improve the stability and generalization ability of model [14]. Multiple weak learners are combined into a strong learner, such as random forest, Ad boost, etc., and their advantages are comprehensively utilized to obtain more reliable prediction results. Of course, the evaluation and verification of the model is also an indispensable link. Use a variety of evaluation indicators, such as accuracy, recall, mean square error, etc., to evaluate the model comprehensively. According to the evaluation results, the model is adjusted and improved. However, the financial market is dynamic, and the model needs to be constantly updated and optimized. Incorporate new data for training in time to adapt to the latest changes in the market and ensure that the forecasting ability of the model is always at a high level. The optimization process is shown in the following figure:

Figure. 2 Optimization flow chart.

Optimization based on machine learning algorithm

The detailed steps of optimization based on machine learning algorithm are as follows:

(1) Introduction of objective function:

\[ f(x_i) = \frac{1}{l} \sum_{i=1}^{l} y_i \cdots (3) \]

In the above formula, f is the convergence coefficient; L is the particle dimension.

(2) Substituting Ji into Formula (3) as xi, the antibody formed at this time is the particle in the particle group. The updating of particle swarm is completed by updating the equation, and it has the inertia weight. If the updated antibody swarm is obtained and the convergence speed is improved, the calculation formula of updating the equation is as follows:

\[ v = wv_i + c_1 r_1 (p_i – J_i) + c_2 r_2 (p_g – J_i) \cdots (4) \]

In the above formula, I = 1,2, …, m, m represents the number of particles; Ji is its location; Vi represents the flight speed, and vi∈[-vmax,vmax], and the vmax value represents the global search ability of the group; Pi and pg both represent the best positions, corresponding to the individual and population of particles respectively. The inertia weight is described by W, which can determine the inertia of particle swarm and increase the search space of particle swarm. C1 and c2 represent velocity constants, both positive real numbers; R1 and r2 represent random numbers, and the variation range is [0,1].

(3) Affinity calculation. To prevent the updated particle swarm from entering the local optimum, the particle swarm is treated by adding value and deleting, and the solution formula is as follows:

\[ A(i) = \frac{1}{1 + e^{t_{ji}}} \cdots (5) \]

In the above formula, t represents a constant and is greater than zero.

(4) High-mutation cloning: In the current research field of biological science, as an efficient antibody production strategy, the core of high-mutation cloning technology lies in the use of advanced means of high affinity and antibody replication. Specifically, by precisely mutating individual particles, their potential diversity can be activated, thus generating a series of antibody clones with different biological characteristics [15]. On this basis, through the implementation of targeted screening and optimization strategies, researchers can achieve fine regulation of highly mutated clonal populations. This process not only requires a deep understanding of the generation mechanism of mutant clones but also requires strict control of the later screening and optimization steps. Ultimately, the goal of this technology is to obtain new antibodies that have excellent biological characteristics and can cope with complex biological challenges. Among them, high affinity individuals constitute a new generation of antibody population, and the cell population containing mother cells is a necessary part of cloning. The cloning formula is:

\[ J^r = s + \delta \xi s(r) \cdots (6) \]

\[ s = \alpha e^{\beta \left[ \frac{\min(i) – A(i)}{\max(i) – \min(i) + \xi} \right]} \cdots (7) \]

In the above formula: min(I)=min[A(I)], max (I) = max [a (I)]; α and δ are constants that can control the degree of variation. Normal numbers and positive numbers are expressed by β and ξ respectively, and the latter is the smallest value. R represents a random number, which belongs to Gaussian distribution, S stands for transition factor.

(5) In order to determine the individuals with the best parameters, individuals with high affinity need to be obtained, and the search is completed globally.

And (6) judging whether to finish, if so, outputting the result, otherwise, returning to the step (2) until the end.

Conclusion

Through this study, we can find that the application of machine learning algorithms in financial markets has achieved remarkable results under the background of continuous development of science and technology. The financial market forecasting model based on machine learning not only has the characteristics of high efficiency and high precision but also can accurately forecast in a complex financial environment.

For the optimization strategy of the model, it is optimized comprehensively from the aspects of algorithm selection, parameter adjustment, data processing and so on. These optimization processes not only improve the prediction accuracy of the model but also enhance the stability and generalization ability of the model.

In the future, with the continuous progress of technology and the continuous development of financial markets, the application of machine learning in financial market forecasting will be more extensive and in-depth. Therefore, the optimization of financial market forecasting model based on machine learning is a far-reaching research direction, which deserves more attention and investment.

Acknowledgements

This work was not supported by any funds. The authors would like to show sincere thanks to those techniques who have contributed to this research.

References

[1] Srivastava, P. R., Zhang, Z. J., Ecchumati, P. (2021) Deep neural network and time series approach for finance systems: predicting the movement of the Indian stock market. Journal of Organizational and End User Computing (JOEUC), 33(5), 204-226.

[2] Fathia, Z., Kodia, Z., Ben Said, L. (2022) Stock market prediction of Nifty 50 index applying machine learning techniques. Applied Artificial Intelligence, 36(1), 2111134.

[3] Ashtiani, M. N., Raheim, B. (2023) News-based intelligent prediction of financial markets using text mining and machine learning: A systematic literature review. Expert Systems with Applications, 217, 119509.

[4] Goel, A., Goel, A. K., Kumar, A. (2023) The role of artificial neural network and machine learning in utilizing spatial information. Spatial Information Research, 31(3), 275-285.

[5] Tang, D. (2023, May) Optimization of Financial Market Forecasting Model Based on Machine Learning Algorithm. In 2023 International Conference on Networking, Informatics and Computing (ICNETIC) (pp. 473-476). IEEE.

[6] Zheng, H., Wu, J., Song, R., Guo, L., Xu, Z. (2024) Predicting financial enterprise stocks and economic data trends using machine learning time series analysis. Applied and Computational Engineering, 87, 26-32.

[7] Mohanty, D. K., Parida, A. K., Khuntia, S. S. (2021) Financial market prediction under deep learning framework using auto encoder and kernel extreme learning machine. Applied Soft Computing, 99, 106898.

[8] Kumbure, M. M., Lohrmann, C., Luukka, P., Porras, J. (2022) Machine learning techniques and data for stock market forecasting: A literature review. Expert Systems with Applications, 197, 116659.

[9] Rouf, N., Malik, M. B., Arif, T., Sharma, S., Singh, S., Aich, S., Kim, H. C. (2021) Stock market prediction using machine learning techniques: a decade survey on methodologies, recent developments, and future directions. Electronics, 10(21), 2717.

[10] Sahu, S. K., Mokhade, A., Bokde, N. D. (2023) An overview of machine learning, deep learning, and reinforcement learning-based techniques in quantitative finance: recent progress and challenges. Applied Sciences, 13(3), 1956.

[11] Lukita, C., Bakti, L. D., Rusilowati, U., Sutarman, A., Rahardja, U. (2023) Predictive and analytics using data mining and machine learning for customer churn prediction. Journal of Applied Data Sciences, 4(4), 454-465.

[12] Lv, M., Li, J., Niu, X., Wang, J. (2022) Novel deterministic and probabilistic combined system based on deep learning and self-improved optimization algorithm for wind speed forecasting. Sustainable energy technologies and assessments, 52, 102186.

[13] Sarker, I. H. (2021) Data science and analytics: an overview from data-driven smart computing, decision-making and applications perspective. SN Computer Science, 2(5), 377.

[14] Zhou, G., Liu, L., Luo, S. (2022) Sustainable development, ESG performance and company market value: Mediating effect of financial performance. Business Strategy and the Environment, 31(7), 3371-3387.

[15] Giglio, S., Kelly, B., Xiu, D. (2022) Factor models, machine learning, and asset pricing. Annual Review of Financial Economics, 14(1), 337-368.