On January 23th, gold prices set a new all-time high. The international spot gold price peaked at $4,967.37 per ounce. The sharp rise in international gold prices quickly spread to the domestic market. The quoted prices of gold jewelry from major domestic brands surged significantly, generally exceeding 1,500 yuan per gram.

With the accumulation of national wealth and the rapid development of the financial market, personal financial management is no longer exclusive to a small group of people. It has become a compulsory course related to the well-being of every family. In this era full of opportunities and challenges, how to protect personal wealth and optimize household asset allocation has become a common concern of the public. For investors in particular, understanding the trend of financial policies is an important prerequisite for making investment decisions.

Faced with the strong upward trend of gold prices, market sentiment has shown a clear differentiation. On one hand, some investors regard gold as a “hard currency” against inflation and geopolitical risks. They have entered the market one after another, hoping to achieve asset appreciation by taking advantage of the gold price rally. On the other hand, many professional analysts have issued rational warnings.

Current gold prices are already in a historically high range. The room for future growth may be restricted by multiple factors. These factors include changes in the Federal Reserve’s interest rate hike expectations and the global economic recovery process. Blindly chasing the upward trend hides considerable correction risks. For ordinary households, gold is indeed an indispensable part of asset allocation, but it is by no means a “universal key”.

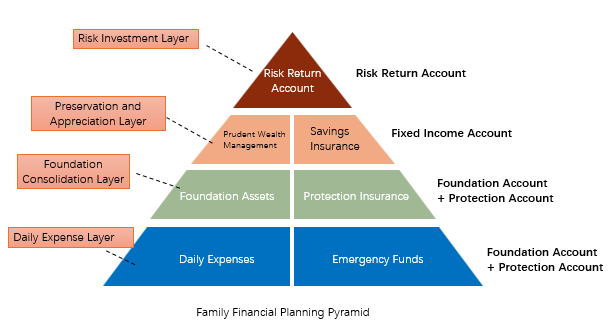

From the perspective of classic asset allocation logic, the proportion of gold in household wealth should not be too high. It is generally recommended to keep it within a reasonable range of 10% to 15%. Overweighting gold will reduce the flexibility and risk resistance of the asset portfolio. In addition to safe-haven assets such as gold, households should also build a diversified asset allocation framework based on personal risk tolerance, investment cycle and wealth goals. For conservative households with low-risk appetite, low-risk assets can serve as the core of allocation. These assets include bank time deposits, treasury bonds and stable wealth management products.

For households pursuing steady returns, the proportion of high-quality bond funds and blue-chip stock funds can be appropriately increased. For households with stronger risk tolerance and longer investment cycles, a small proportion of high-risk assets can be allocated. These assets include stocks and equity funds, to seek higher long-term returns.

At the same time, understanding the linkage between macroeconomic policies and the financial market is also the key to households’ sound asset allocation. The monetary policy trends of the Federal Reserve not only affect the trend of gold prices, but also exert a far-reaching impact on global stock and foreign exchange markets.

Domestic policy adjustments such as reserve requirement ratio cuts and interest rate cuts also directly affect the return performance of various investment products. Only by continuously following policy trends and optimizing asset allocation schemes in a timely manner based on market dynamics can households truly protect their wealth in a complex and volatile market environment.